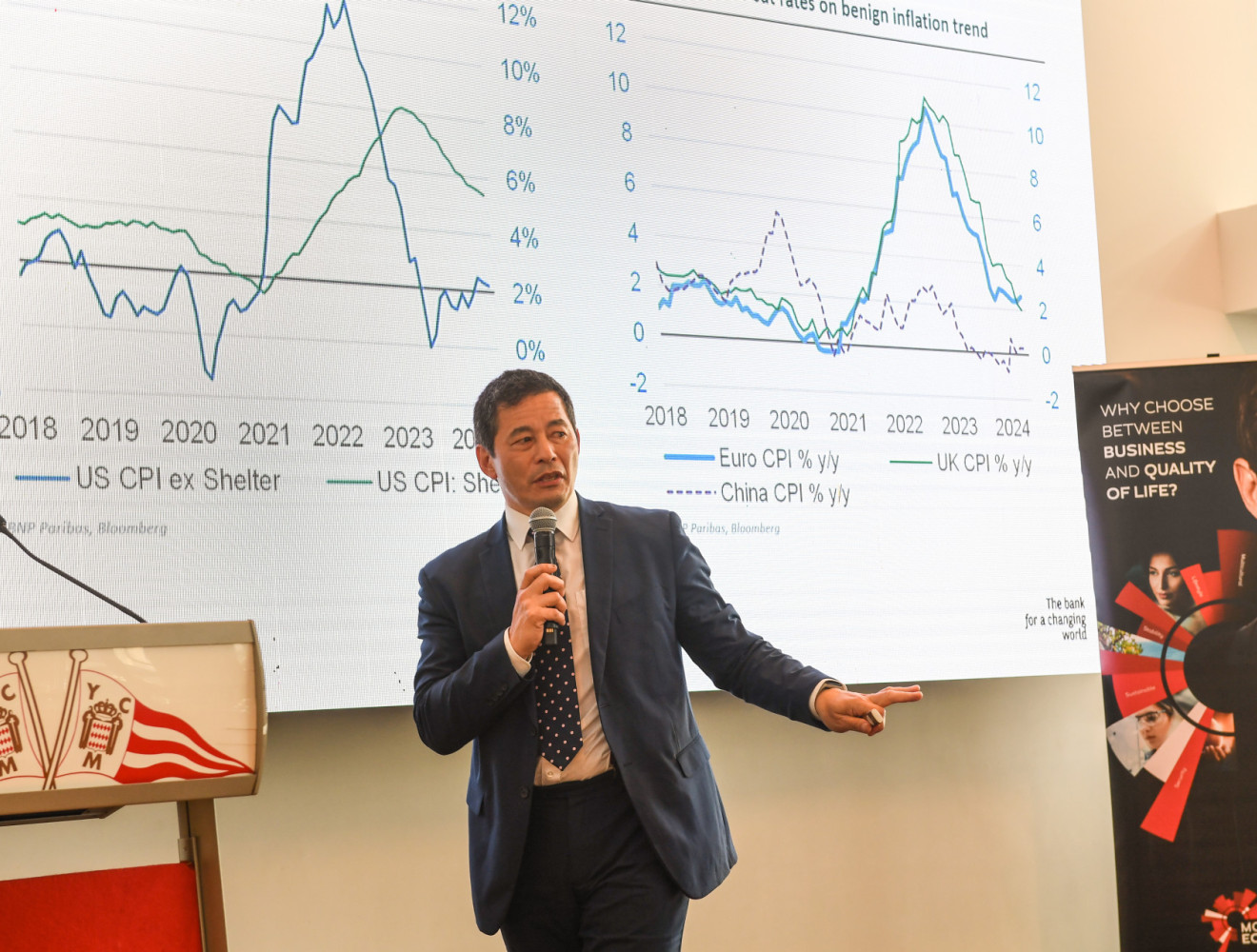

Edmund Shing of BNP Paribas Wealth Management is an economist who makes people love finance!

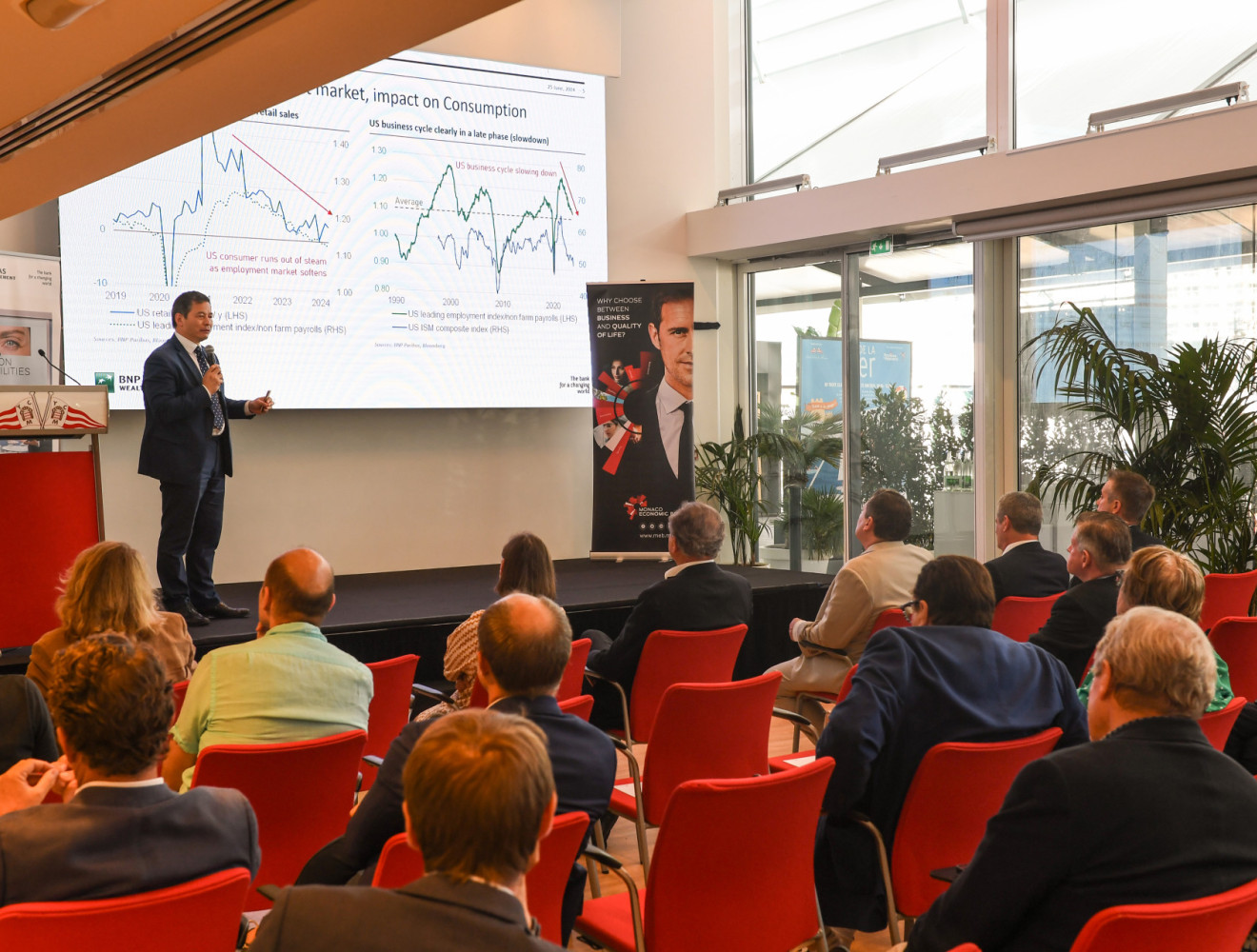

On Tuesday, 25th June, at the Yacht Club de Monaco, the Monaco Economic Board (MEB), in partnership with BNP Paribas Wealth Management, welcomed Edmund Shing, the banking group's Director of Global Investments, to one of its English-language conferences. Based in London, the economist delighted the entrepreneurs and finance professionals present with his crystal-clear speech on subjects that might appear complex and was quick to offer a wealth of investment advice. An outstanding teacher.

After a welcome from Guillaume Rose, Executive General Manager of the MEB, Eric Aubin, Director of Wealth Management at BNP Paribas Wealth Management in Monaco, reminded the audience that the bank was celebrating its 120th anniversary in the Principality before handing over to the speaker of the day, who was attending the Monaco Economic Conferences for the second year running.

Focusing first on the United States, Edmund Shing looks at the slowdown in growth caused in part by the cut in the Fed's key interest rates in its fight against inflation: "This fall in activity has encouraged companies to cut their costs, notably by reducing their workforce, which has automatically led to a fall in consumption. Consumption accounts for 80% of growth in the US economy or 20% of global growth. My advice: keep an eye on the US employment curve!” Indeed, with a policy of lowering interest rates set to continue until 2025, there is a risk of a recession in Uncle Sam's country.

Another consequence is that this is no longer the time to invest in currencies. Edmund Shing prefers equities in particular: "Even if the markets have broken records, it's still worth betting on equities as long as the fundamentals are good". Markets that have disappointed in recent years could become good opportunities, such as the UK, Japan, or even China. On the other hand, if a recession were to occur, it would be better to fall back on bonds (which are loans issued by companies on the markets).

The Investment Director of BNP Paribas Wealth Management, who repeated the mantra of constantly diversifying his portfolio, was also very interested in specific commodities such as gold, a haven that never disappoints in the medium and long term, silver and platinum, which are a little riskier, and copper, an essential metal in the energy transition, which is very promising. Similarly, water-related sectors have a bright future ahead of them as demand constantly grows.

When asked about lithium, which is very much in vogue, he was more circumspect: "It is already very high, and future battery technologies should be able to do without it." Similarly, in his view, betting on cryptocurrencies is like gambling in a casino. While technology in the US is doing well, the returns are not living up to its reputation, especially as a bubble already appears in AI, even though the sector is not yet mature.

Finally, Edmund Shing offered a wealth of sound advice based on concrete data, with an optimistic outlook, whilst exercising caution.

Photo credits: MEB / P.H. Sébastien Darrasse

From l to r : Guillaume Rose, Executive Managing Director of the MEB; Françoise Puzenat, Managing Director of BNP Paribas Wealth Management Monaco; Edmund Shing, Global Investment Director of BNP Paribas Wealth Management; Michel Dotta, Chairman of the MEB; Eric Aubin, Director of Wealth Management of BNP Paribas Wealth Management Monaco